The S&P 500 encompasses a wide range of industries, providing investors with opportunities to participate in various sectors. By investing in individual ETFs that track these sectors, investors can diversify their portfolios and potentially enhance returns. Many key S&P 500 sector ETFs exist, offering exposure to consumer discretionary, energy, utilities, and more. Each sector presents its own unique risks, and understanding these dynamics is crucial for making strategic investment decisions.

For example, a technology ETF might be susceptible to shifts in the tech market, while a healthcare ETF could benefit from increasing healthcare costs. Meticulous research and analysis of individual ETFs within each sector are essential to tailoring your portfolio with your financial objectives.

Dissecting S&P 500 Sector ETF Trajectories in 2023

This year has witnessed significant movements across various sectors within the S&P 500. Investors are closely monitoring the performance of sector-specific ETFs to gauge market sentiment and upcoming investment strategies. The technology sector, for instance, has shown robust growth despite ongoing macroeconomic pressures. Conversely, the materials sector has faced volatility due to geopolitical tensions. Analyzing these varied performances is essential for financial advisors to make informed decisions.

Leading S&P 500 Sector ETFs for Long-Term Growth

For investors seeking long-term growth potential, sector-specific exchange-traded funds (ETFs) tracking the S&P 500 can offer targeted exposure to markets with strong performance trends. Pinpointing the top-performing ETFs in each sector requires careful evaluation of recent returns, underlying holdings, and future potential.

- Consider ETFs focused on sectors like consumer discretionary which have historically demonstrated robust growth.

- Employ diversification by investing in a combination of sector ETFs to mitigate risk.

- Continue informed about market trends and economic conditions that can impact sector performance.

It's essential to conduct thorough due diligence and consult a financial advisor before making any investment decisions.

Unlocking Opportunities with S&P 500 Sector ETFs

Diversifying your investments across different sectors within the S&P 500 can be a strategic move to mitigate risk and capture growth opportunities. Exchange-traded funds (ETFs) provide a convenient and cost-effective way to gain exposure to specific sectors, allowing investors to tailor their allocations based on market trends and individual preferences.

By investing in sector ETFs that track the performance of industries such as technology, healthcare, financials, or energy, investors can potentially benefit from the unique characteristics and growth prospects of each sector. For example, an ETF focused on the technology sector may offer exposure to innovative companies driving advancements in artificial intelligence, cloud computing, or cybersecurity. automated trading strategies Alternatively, a healthcare sector ETF could provide diversification through investments in pharmaceutical companies, biotech firms, or medical device manufacturers.

It's important to conduct thorough research and consider your risk tolerance when selecting sector ETFs. Consulting with a financial advisor can help you develop a well-diversified portfolio that aligns with your investment aspirations.

Prudent Investing in S&P 500 Sector ETFs: A Risk Management Approach

For diversified portfolios seeking exposure to the S&P 500 while implementing a robust risk management framework , sector ETFs present an attractive avenue. By allocating assets across various sectors, investors can mitigate overall portfolio volatility and augment the potential for sustainable returns. A key element in this approach is regularly rebalancing sector allocations to copyright the desired investment profile . This flexible strategy allows investors to capitalize market shifts while controlling potential downside exposure .

- Leveraging sector ETFs can furnish a more specific investment approach within the broad S&P 500 index.

- Meticulous research is crucial to select sectors with strong growth opportunities.

Exploring the Broad Market: Examining Niche S&P 500 Sector ETFs

While many investors gravitate towards broad market portfolios, a wealth of opportunity lies in niche S&P 500 sector ETFs. These specialized funds target on specific industries or subsectors within the index, allowing investors to customize their portfolios for targeted allocation. From the thriving technology sector to the core healthcare industry, niche ETFs offer a means to capitalize on emerging trends and specialized market opportunities.

- Consider ETFs that track sectors with strong momentum.

- Spread your portfolio across multiple niche sectors to reduce volatility.

Remember that niche ETFs often carry elevated risks compared to broader market funds, so it's crucial to carefully analyze before allocating capital.

Michael J. Fox Then & Now!

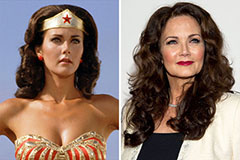

Michael J. Fox Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!